We have cooperated with more than 200 countries in solar energy projects and road lighting projects. We have exported products to many countries and participated in many important government projects around the world.

Installing a solar power system in California will continue to provide significant financial incentives through 2026 as the solar tax credit from federal law being the most important benefit for homeowners and business. Although California does not offer the state-wide solar tax credit for income, the combination of state-level incentives and federal policies will significantly reduce the cost of solar panels.

This article will explain what the California solar tax credit will work in 2026. It also explains who qualifies and what expenses are qualified and how battery storage is handled and how state programs are interacted together with the Clean Electricity Investment Credit (CEIC).

FIY: The Federal Investment Tax Credit (ITC) and the new Clean Electricity Investment Credit (CEIC) are key Inflation Reduction Act (IRA) incentives providing a 30% or higher tax reduction for renewable energy projects. The ITC applies to projects placed in service before 2025, while the tech-neutral CEIC replaces it for projects starting in 2025, requiring zero greenhouse gas emissions.

The term "California solar tax credit" is a reference to a variety of incentives instead of one tax credit administered by the state program. In 2026 the solar systems owners of California will benefit most from:

The Clean Electricity Investment Credit (CEIC)

Federal Solar Tax Credit (ITC)

California's exclusion of property taxes for solar power systems

Net Billing (NEM 3.0) rules that impact energy export compensation

Choose either utility or local rebates

California doesn't currently provide an statewide personal income tax credit that is specifically geared towards solar-powered installations.

The Federal Investment Tax Credit (ITC) continues to provide a 30% tax credit for eligible solar energy systems installed and placed in service between 2022 and 2032, as guaranteed by the Inflation Reduction Act of 2022 (IRA).

Credit Percentage (2026)

In 2026, the ITC remains at 30% of the total eligible system cost. This rate applies to both residential and commercial solar energy installations. The credit will begin phasing down after 2032 unless extended by future legislation.

Eligible Costs

The 30% tax credit applies to:

Solar photovoltaic (PV) panels

Solar inverters (string, hybrid, or microinverters)

Mounting racks, racking systems, and other balance-of-system components

Electrical wiring and associated equipment

Energy storage systems (battery storage) that are installed with or after the solar system

Installation and labor costs

Important Notes:

There is no cap on the dollar amount of the credit you can claim.

Homeowners claim the ITC using IRS Form 5695 (Residential Energy Credits).

Businesses claim their credit using IRS Form 3468 (Investment Credit).

Future Transition (After 2025)

The Clean Electricity Investment Credit (CEIC)—a new, technology-neutral incentive—will replace the ITC for new projects starting in 2025 or later years that meet the requirement of producing zero or net-negative greenhouse gas emissions.

However, for all solar PV systems placed in service during 2026, the 30% ITC still fully applies under the current IRA framework.

In order to be eligible to receive the tax credits for solar for 2026, these requirements must be fulfilled:

The solar panel must be installed on the property that is located in California

A person applying for the loan must be the owner of the system (leased systems will not count)

The system should be put in operation by the tax year 2026

The applicant must have a sufficient federal tax liabilities to be eligible for the credit

The same rules apply to residential as well as commercial solar panels.

California is continuing to provide the property tax exemption for solar energy systems with a qualifying system until 2026.

The value added by an installation of solar energy is not included in assessment of property tax.

Property owners are not required to have to pay more property taxes due to the installation of solar

The exclusion is in force until 2026 in accordance with the current state law.

The incentive is not cash, but provides the potential for tax reductions over time.

California's Net Billing program often referred to as NEM 3.0, remains in place until 2026.

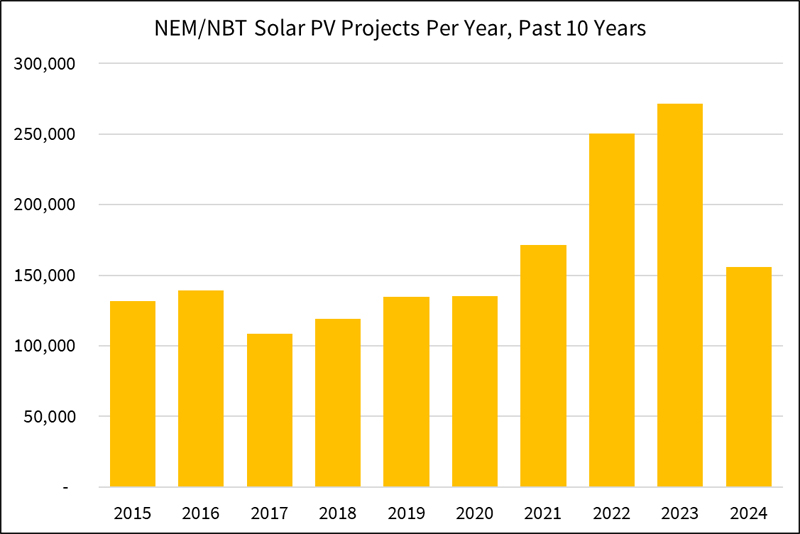

NEM/NBT solar PV projects per year (2015-2024)

The introduction of the Net Billing Tariff

Solar energy exported in excess for grid use is repaid with reduced costs

Export compensation is much less than the retail electricity price

Pricing for time-of-use plays an important part in economics of the system.

Batterie storage enhances self-consumption as well as financial returns

Net billing does not impact the eligibility for tax credits, but it strongly impacts the design of the system.

Storage systems for battery energy qualify in the tax incentive for solar energy offered by Congress from 2026 even if they are they are installed separately from solar panels.

Capacity minimum: 3-kilowatt hours (kWh)

Can be used with or without the solar PV system

You are eligible in the exact 30 percent federal tax credit.

This policy is a major element of modern solar projects in California.

Businesses that install solar panels in California by 2026 may be eligible to:

The 30 percent federal ITC

Accelerated depreciation in the MACRS

Potential bonus depreciation and dependent on IRS rules

Municipal, utility and regional incentives programs

These incentives can drastically lower the cost of commercial solar projects.

If a solar project does not meet the eligibility requirements:

The tax credit could be lowered or eliminated

Incorrectly filed claims could trigger IRS audits, or penalities

System invoices, contracts and dates for commissioning have to be recorded

Insuring compliance with federal as well as state laws is essential.

The solar tax credit for federal taxpayers is set to remain at 30 percent until 2026.

California doesn't offer an individual solar credit on income taxes.

Solar Inverters, solar panels, storage batteries, and installation costs are all eligible

The exclusion of property taxes from the tax code stops the property tax from rising due to solar energy.

Battery storage can be used independently to qualify for federal tax credits

Net Billing (NEM 3.0) can affect the amount of energy paid, but not the eligibility for tax credits.

Both commercial solar systems and residential solar systems can be considered

There is a California solar tax credit that will expire in 2026 will continue to offer strong financial incentives via the Federal Investment Tax Credit and supportive state policies. The incentive structure in California has changed to self-consumption as well as energy storage, properly constructed solar panels can still provide significant savings over the long term.

Understanding the eligibility rules, requirements for documentation and the design of system is crucial to maximize the available incentives while ensuring compliance until 2026.